Pay Property Tax King County Wa . king county treasury began sending out property tax bills on february 15, 2022. Select the payment you would like to make: pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. First half of 2024 property taxes are due april 30th sign up for text or email reminders. contact the assessor's office. pay or view your account online, pay in person at the king county customer service center, do a property search, or. The first half of this year's taxes were due may 2. pay your property taxes. Pay your capacity charge bill. check your tax statement or property value notice. make a payment to king county. Use ereal property search to look up your parcel information by entering your. How we assess residential property. The remainder are due by. We assess your property each year at market value.

from kingcounty.gov

First half of 2024 property taxes are due april 30th sign up for text or email reminders. We assess your property each year at market value. pay or view your account online, pay in person at the king county customer service center, do a property search, or. king county treasury began sending out property tax bills on february 15, 2022. Use ereal property search to look up your parcel information by entering your. The first half of this year's taxes were due may 2. make a payment to king county. Pay your capacity charge bill. How we assess residential property. contact the assessor's office.

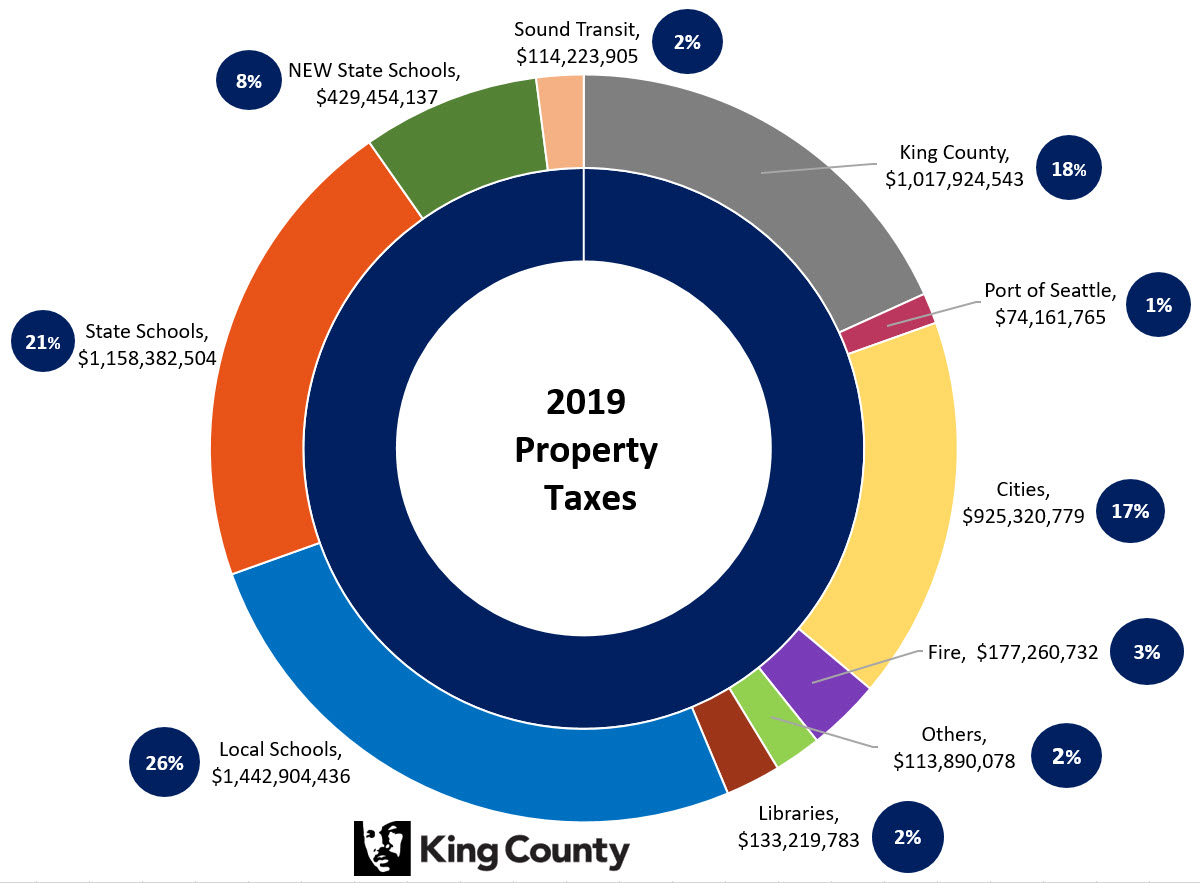

2019 Taxes King County, Washington

Pay Property Tax King County Wa The first half of this year's taxes were due may 2. pay your property taxes. king county treasury began sending out property tax bills on february 15, 2022. Pay your capacity charge bill. pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. contact the assessor's office. check your tax statement or property value notice. First half of 2024 property taxes are due april 30th sign up for text or email reminders. The first half of this year's taxes were due may 2. Use ereal property search to look up your parcel information by entering your. Select the payment you would like to make: pay or view your account online, pay in person at the king county customer service center, do a property search, or. How we assess residential property. The remainder are due by. make a payment to king county. We assess your property each year at market value.

From www.kiro7.com

King County launches plan to help seniors, others with Pay Property Tax King County Wa make a payment to king county. First half of 2024 property taxes are due april 30th sign up for text or email reminders. king county treasury began sending out property tax bills on february 15, 2022. Use ereal property search to look up your parcel information by entering your. The first half of this year's taxes were due. Pay Property Tax King County Wa.

From propertytaxgov.com

Property Tax King 2023 Pay Property Tax King County Wa Use ereal property search to look up your parcel information by entering your. The first half of this year's taxes were due may 2. make a payment to king county. pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. The remainder are due. Pay Property Tax King County Wa.

From exolealkt.blob.core.windows.net

King County Wa Real Estate Taxes at Victor Minnick blog Pay Property Tax King County Wa pay or view your account online, pay in person at the king county customer service center, do a property search, or. Select the payment you would like to make: make a payment to king county. king county treasury began sending out property tax bills on february 15, 2022. We assess your property each year at market value.. Pay Property Tax King County Wa.

From patch.com

Property Tax Deadline Nears For King County Homeowners Seattle, WA Patch Pay Property Tax King County Wa pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. How we assess residential property. pay your property taxes. The first half of this year's taxes were due may 2. make a payment to king county. First half of 2024 property taxes are. Pay Property Tax King County Wa.

From propertytaxgov.com

Property Tax King 2023 Pay Property Tax King County Wa Use ereal property search to look up your parcel information by entering your. pay your property taxes. Pay your capacity charge bill. make a payment to king county. contact the assessor's office. pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for.. Pay Property Tax King County Wa.

From propertytaxgov.com

Property Tax King 2023 Pay Property Tax King County Wa Pay your capacity charge bill. pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. We assess your property each year at market value. pay your property taxes. First half of 2024 property taxes are due april 30th sign up for text or email. Pay Property Tax King County Wa.

From kingcounty.gov

2017 Taxes King County, Washington Pay Property Tax King County Wa pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. Select the payment you would like to make: Use ereal property search to look up your parcel information by entering your. First half of 2024 property taxes are due april 30th sign up for text. Pay Property Tax King County Wa.

From kingcounty.gov

2019 Taxes King County, Washington Pay Property Tax King County Wa check your tax statement or property value notice. pay your property taxes. The first half of this year's taxes were due may 2. contact the assessor's office. make a payment to king county. First half of 2024 property taxes are due april 30th sign up for text or email reminders. The remainder are due by. How. Pay Property Tax King County Wa.

From kingcounty.gov

2018 Taxes King County, Washington Pay Property Tax King County Wa Select the payment you would like to make: check your tax statement or property value notice. pay your property taxes. pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. make a payment to king county. contact the assessor's office. . Pay Property Tax King County Wa.

From twitter.com

King County, WA on Twitter "King County property owners can now view Pay Property Tax King County Wa pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. contact the assessor's office. How we assess residential property. pay your property taxes. Use ereal property search to look up your parcel information by entering your. make a payment to king county.. Pay Property Tax King County Wa.

From prorfety.blogspot.com

Personal Property Tax King County Wa PRORFETY Pay Property Tax King County Wa check your tax statement or property value notice. How we assess residential property. pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. We assess your property each year at market value. Pay your capacity charge bill. The remainder are due by. The first. Pay Property Tax King County Wa.

From exokirubd.blob.core.windows.net

Property Tax King County Assessor at Mari Moore blog Pay Property Tax King County Wa How we assess residential property. pay or view your account online, pay in person at the king county customer service center, do a property search, or. We assess your property each year at market value. Select the payment you would like to make: make a payment to king county. The remainder are due by. contact the assessor's. Pay Property Tax King County Wa.

From kingcounty.gov

King County Sales Tax King County Pay Property Tax King County Wa Use ereal property search to look up your parcel information by entering your. pay or view your account online, pay in person at the king county customer service center, do a property search, or. pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for.. Pay Property Tax King County Wa.

From exolealkt.blob.core.windows.net

King County Wa Real Estate Taxes at Victor Minnick blog Pay Property Tax King County Wa How we assess residential property. The first half of this year's taxes were due may 2. king county treasury began sending out property tax bills on february 15, 2022. Select the payment you would like to make: pay your property taxes. make a payment to king county. contact the assessor's office. Use ereal property search to. Pay Property Tax King County Wa.

From prorfety.blogspot.com

King County Washington Property Tax Calculator PRORFETY Pay Property Tax King County Wa check your tax statement or property value notice. Use ereal property search to look up your parcel information by entering your. The remainder are due by. make a payment to king county. Pay your capacity charge bill. pay or view your account online, pay in person at the king county customer service center, do a property search,. Pay Property Tax King County Wa.

From ziaqcarlynne.pages.dev

Property Tax King County 2024 Patsy Caitlin Pay Property Tax King County Wa pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. pay your property taxes. make a payment to king county. Select the payment you would like to make: check your tax statement or property value notice. Pay your capacity charge bill. The. Pay Property Tax King County Wa.

From propertytaxgov.com

Property Tax King 2023 Pay Property Tax King County Wa contact the assessor's office. pay your property taxes. Pay your capacity charge bill. The first half of this year's taxes were due may 2. pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. make a payment to king county. First half. Pay Property Tax King County Wa.

From kingcounty.gov

2015 Property Tax Pay Property Tax King County Wa check your tax statement or property value notice. Pay your capacity charge bill. pay or view your account online, pay in person at the king county customer service center, do a property search, or sign up for. The remainder are due by. pay your property taxes. We assess your property each year at market value. Use ereal. Pay Property Tax King County Wa.